iZettle launches with EE in Britain helping electricians secure up to £283m in lost customer payments70% of electricians are currently owed up to £5,000 by late or non-paying customers, which equates to £283m across the UKiZettle mini chip-card reader with free mobile payment app turns businesses’ smartphones and tablets into credit and debit card readersEE named as exclusive UK iZettle launch partner, with the device initially available in 297 of its retail stores

From today, iZettle mini chip-card readers, that turn smartphones and tablets into mobile payments terminals, can be purchased exclusively in 297 newly designed EE stores across the country and from EE’s telesales channel. The social payment company’s new device and free app could help electricians secure millions of pounds they are owed by customers. For example, 70% of electricians are currently owed up to £5,000 by late or non-paying customers, according to an EE survey of 1,029 tradespeople. This equates to £283 million owed to tradespeople across the UK.

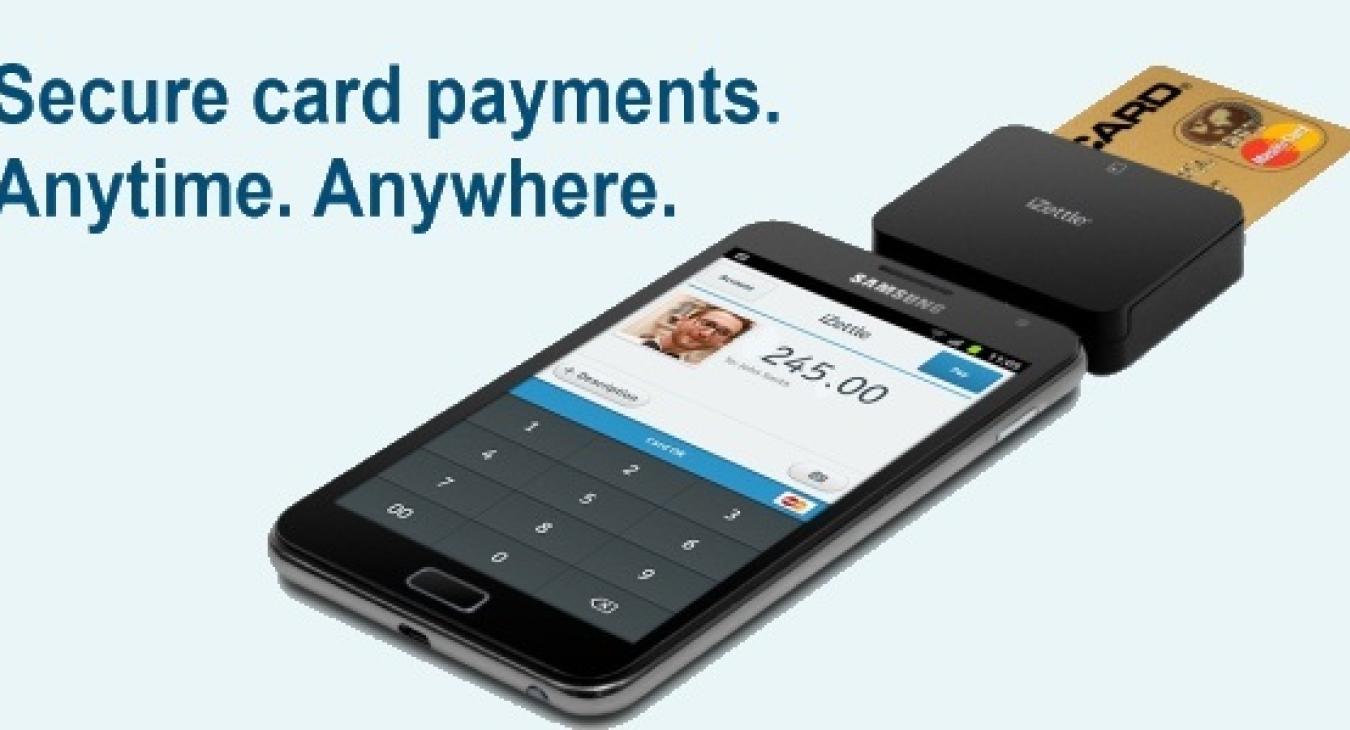

iZettle’s mobile payments card readers, which can be used with iPhones, iPads, and more than a dozen 2.1 and higher Android smartphones and tablets including the Samsung Galaxy range, cost £20 in EE stores and come with a £20 voucher that can be used towards iZettle transaction fees. With iZettle merchants can accept Visa, MasterCard, American Express and Diners Club payments. There are no lengthy sign up processes, no set up fees, no monthly fees and no minimum spend. iZettle merchants are simply charged 2.75% of each payment.

“The beauty of iZettle is that it’s simple to use, totally secure and takes seconds for a transaction,” said Jacob de Geer, CEO and co-founder of iZettle, which is used by more than 75,000 small businesses and individuals in six countries. “Whether you are a cabbie, florist, tradesperson or a courier, iZettle gives you the flexibility to operate in both cash and cards. The possibilities are endless because hundreds of thousands of small business can now take plastic. We are very excited about our full commercial launch in the UK and the positive results of our Beta test with 4,000 users over the past six months.”

Research revealed today by EE, which has just launched its new superfast 4G and fibre brand in the UK, shows that electricians are investing an average of 36 days every year chasing overdue customer bills. Even based on minimum wage rates, that means the time spent chasing customers for payment costs tradespeople up to £125 million a year.

Accepting card payments could easily boost revenue and cash flow, but 49% of electricians have been previously put off due to the cost of accepting cards. However, 74% claim they would accept credit or debit cards if there was a low cost, low hassle way of doing so. iZettle meets this need with an effortless sign-up and stress-free system that has one of the lowest cost and complexity profiles on the market. While according to consumers, there is also a pent-up demand with 82% saying they would like the option to pay tradespeople by card.

Gerry McQuade, Chief Marketing Officer at EE said: “iZettle is a revolution for small businesses and consumers across the nation. The aim of our new superfast EE brand is to make businesses’ digital lives easier and ultimately more profitable through technology. Businesses and consumers are on the cusp of mobile payment transformation and we are delighted to bring iZettle to market, enhancing our mobile payment portfolio.”

iZettle is designed for small business and tradespeople such as plumbers, electricians, builders, taxi drivers, housekeepers or market stallholders. It is estimated that there may be more than three million people running businesses in the UK who would benefit from the flexibility iZettle offers, with two thirds (66%) of small firms currently owning a smartphone.

News Categories